LIC Jeevan Saral plan launched in 2004, this policy is with a lot of flexibility. Jeevan Saral policy is one of the easiest policies for common people. This policy is pure protection for your family, in case of policyholder's death; this policy will easily replace the breadwinner's income. Mar 27, 2017 LIC Policy Status Online. LIC of India Policy Status Enquiry helps you to know the status of your LIC policy. Tracking your own policy status is significant because it allows the policyholder to know the details of next premium due, accumulated bonus, loan status, claim status, revival quote etc. LIC Jeevan Saral plan is also known as atm plan. It is an endowment policy available only with unit linked insurance plans. The premium payment amount is decided by the policyholder andthe resulting Sum Assured will be 250 times the monthly premium. He would receive Maturity Sum Assured + Loyalty Additions. How to Get Duplicate and Download RC? Tag: lic jeevan saral. Ankita Sejpal / January 21, 2020 June 4, 2020. LIC Jeevan Saral Maturity Calculator.

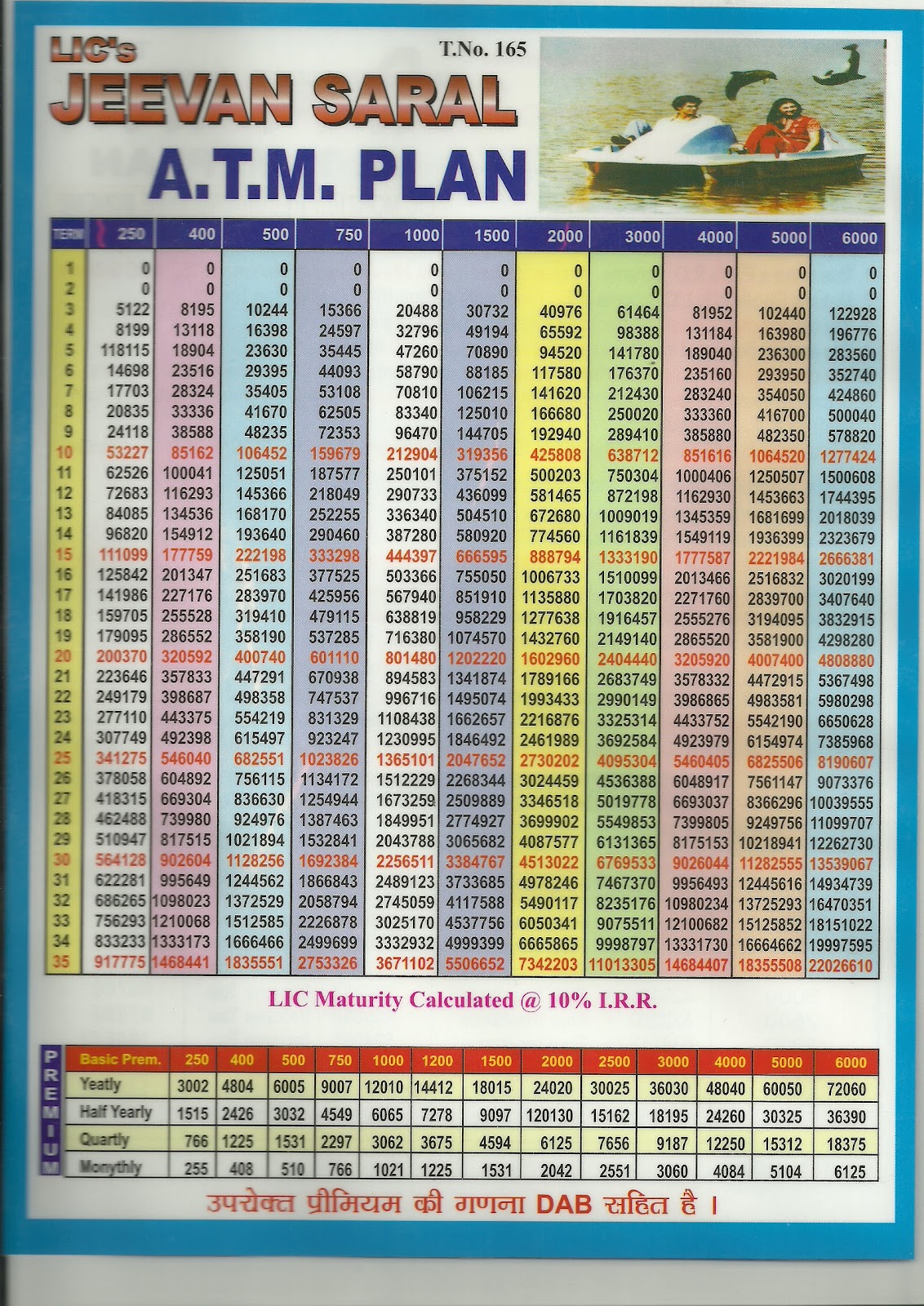

LIC Jeevan Saral plan is also known as atm plan. It is an endowment policy available only with unit linked insurance plans. The premium payment amount is decided by the policyholder andthe resulting Sum Assured will be 250 times the monthly premium. He would receive Maturity Sum Assured + Loyalty Additions. Below is the maturity benefit of LIC Jeevan Saral Chart Plan 165 which displays the maturity amount for the monthly premium against the term period.

Maturity Benefit Chart of Jeevan Saral | ATM Plan LIC Chart

| LIC Jeevan Saral Maturity Amount Chart | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Term | 250 | 400 | 500 | 750 | 1000 | 1500 | 2000 | 3000 | 4000 | 5000 | 6000 |

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | 5122 | 8195 | 10244 | 15366 | 20488 | 30732 | 40976 | 61464 | 81952 | 102440 | 122928 |

| 4 | 8199 | 13118 | 16398 | 24597 | 32796 | 49194 | 65592 | 98388 | 131184 | 163980 | 196776 |

| 5 | 11815 | 18904 | 23630 | 35445 | 47260 | 70890 | 94520 | 141780 | 189040 | 236300 | 283560 |

| 6 | 14698 | 23516 | 29395 | 44093 | 58790 | 88185 | 117580 | 176370 | 235160 | 293950 | 352740 |

| 7 | 17703 | 28324 | 35405 | 53108 | 70810 | 106215 | 141620 | 212430 | 283240 | 354050 | 424860 |

| 8 | 20835 | 33336 | 41670 | 62505 | 83340 | 125010 | 166680 | 250020 | 333360 | 416700 | 500040 |

| 9 | 24118 | 38588 | 48235 | 72353 | 96470 | 144705 | 192940 | 289410 | 385880 | 482350 | 578820 |

| 10 | 53227 | 85162 | 106452 | 159679 | 212904 | 319356 | 425808 | 638712 | 851616 | 1064520 | 1277424 |

| 11 | 62526 | 100041 | 125051 | 187577 | 250101 | 375152 | 500203 | 750304 | 1000406 | 1250507 | 1500608 |

| 12 | 72683 | 116293 | 145366 | 218049 | 290733 | 436099 | 581465 | 872198 | 1162930 | 1453663 | 1744395 |

| 13 | 84085 | 134536 | 168170 | 252255 | 336340 | 504510 | 672680 | 1009019 | 1345359 | 1681699 | 2018039 |

| 14 | 96820 | 154912 | 193640 | 290460 | 387280 | 580920 | 774560 | 1161839 | 1549119 | 1936399 | 2323679 |

| 15 | 111099 | 177759 | 222198 | 333298 | 444397 | 666595 | 888794 | 1333190 | 1777587 | 2221984 | 2666381 |

| 16 | 125842 | 201347 | 251683 | 377525 | 503366 | 755050 | 1006733 | 1510099 | 2013466 | 2516832 | 3020199 |

| 17 | 141986 | 227176 | 283970 | 425956 | 567940 | 851910 | 1135880 | 1703820 | 2271760 | 2839700 | 3407640 |

| 18 | 159705 | 255528 | 319410 | 479115 | 638819 | 958229 | 1277638 | 1916457 | 2555276 | 3194095 | 3832915 |

| 19 | 179095 | 286552 | 358190 | 537285 | 716380 | 1074570 | 1432760 | 2149140 | 2865520 | 3581900 | 4298280 |

| 20 | 200370 | 320592 | 400740 | 601110 | 801480 | 1202220 | 1602960 | 2404440 | 3205920 | 4007400 | 4808880 |

| 21 | 223646 | 357833 | 447291 | 670938 | 894583 | 1341874 | 1789166 | 2683749 | 3578332 | 4472915 | 5367498 |

| 22 | 249179 | 398687 | 498358 | 747537 | 996716 | 1495074 | 1993433 | 2990149 | 3986865 | 4983581 | 5980298 |

| 23 | 277110 | 443375 | 554219 | 831329 | 1108438 | 1662657 | 2216876 | 3325314 | 4433752 | 5542190 | 6650628 |

| 24 | 307749 | 492398 | 615497 | 923247 | 1230995 | 1846492 | 2461989 | 3692984 | 4923979 | 6154974 | 7385968 |

| 25 | 341275 | 546040 | 682551 | 1023826 | 1365101 | 2047652 | 2730202 | 4095304 | 5460405 | 6825506 | 8190607 |

| 26 | 378058 | 604892 | 756115 | 1134172 | 1512229 | 2268344 | 3024459 | 4536688 | 6048917 | 7561147 | 9073376 |

| 27 | 418315 | 669304 | 836630 | 1254944 | 1673259 | 2509889 | 3346518 | 5019778 | 6693037 | 8366296 | 10039555 |

| 28 | 462488 | 739980 | 924976 | 1387463 | 1849951 | 2774927 | 3699902 | 5549853 | 7399805 | 9249756 | 11099707 |

| 29 | 510947 | 817515 | 1021894 | 1532841 | 2043788 | 3065682 | 4087577 | 6131365 | 8175153 | 10218941 | 12262730 |

| 30 | 564128 | 902604 | 1128256 | 1692384 | 2256511 | 3384767 | 4513022 | 6769533 | 9026044 | 11282555 | 13539067 |

| 31 | 622281 | 995649 | 1244562 | 1866843 | 2489123 | 3733685 | 4978246 | 7467370 | 9956493 | 12445616 | 14934739 |

| 32 | 686265 | 1098023 | 1372529 | 2058794 | 2745059 | 4117588 | 5490117 | 8235176 | 10980234 | 13725293 | 16470351 |

| 33 | 756293 | 1210068 | 1512585 | 2268878 | 3025170 | 4537756 | 6050341 | 9075511 | 12100682 | 15125852 | 18151022 |

| 34 | 833233 | 1333173 | 1666466 | 2499699 | 3332932 | 4999399 | 6665865 | 9998797 | 13331730 | 16664662 | 19997595 |

| 35 | 917775 | 1468441 | 1835551 | 2753326 | 3671102 | 5506652 | 7342203 | 11013305 | 14684407 | 18355508 | 2202661 |

Maturity Benefit Chart of LIC Jeevan Saral Plan 165 shows the maturity amount for monthly premium from 250 times to 6000. There is no maturity benefit for 1st & 2nd term period. Partial surrender of policy is allowed after 3rd year. Pdf to microsoft word converter free download.

Related Charts:

Top Calculators

Popular Calculators

Top Categories

LIC Jeevan Saral plan launched in 2004, this policy is with a lot of flexibility. Jeevan Saral policy is one of the easiest policies for common people. This policy is pure protection for your family, in case of policyholder's death; this policy will easily replace the breadwinner's income. The maturity sum amount relies upon the age at the entry of the life to be assured and is survival on till the end of the policy term. It also offers the flexibility of terms and a lot of liquidity. In the case of policyholder's death, the money will go to family members of the policyholder.

Class 66 drivers manual pdf. LIC is one of the trusted brands in the insurance field, where they are providing many types of insurance products for everyone's requirements and budgets. Millions of Indian people put their money and trust in this company to make sure their loved one's future financially secure. It is setting up your secured future with a quality assurance plan under the set of the amount in the mode of premium payment.

Features Of LIC Jeevan Saral Plan

In Jeevan Saral policy, the premium amount will be decided by the policyholder as per his/her requirement, and the sum assured amount will be the 250 times of their monthly premium. At the end of the tenure, they will get the maturity amount [sum assured] with loyalty additions. The maturity sum assured depends on the different entry ages and policy terms that will be informed at the beginning of the policy.

- The policyholder can choose to select the premium amount and sum assured amount as per their requirement.

- You can partial surrender from the 4th year onwards [after the 3rd policy year] certain terms and conditions.

- You will get the demise benefit in addition to the return of premiums barring additional premium and first-year premiums with a loyalty addition.

- Maturity benefits

- The death benefit is directly related to the premiums paid.

- Loyalty additions only after the 10th-year policy.

Eligibility For LIC Jeevan Saral Policy

- The sum assured amount is at least 25 times of the monthly premiums.

- The minimum term is 10 years and the max term is 35 years for the policy.

- The minimum premium payment is 10 years and the maximum premium payment is 35 years.

- The minimal age for insured is 12 years and the maximum is 60 years.

- For maturity, there is no minimum age limit and for maximum age is 70 years age limit.

- You can pay a maximum monthly premium is Rs 10,000.

| Minimum Age | 12 Years |

| Maximum Age | 60 years |

| Policy Term | 10 Years – 35 Years |

| Maximum Monthly Premium | Rs. 10000 |

| Maximum Maturity Age | 70 Years |

| Sum Insured | 250* Monthly Premium |

Jeevan Saral Policy Benefits

- Death Benefits: In the case of policyholder's death within the policy tenure, the complete benefits will go to the nominee including the assured sum amount and return of premiums excluding rider premium and first-year premium amount and additional loyalty amount[if any].

- Maturity Benefits: Policy maturity amount is the sum assured amount with loyalty additional [if any] all amount will come in a lump sum.

- Income Tax Benefits: Under sec 80 C, The amount paid for Jeevan Saral policy premiums are income-tax-free. This policy is tax exempted under the section of 10D, the maturity proceeds of this policy.

- Extra Benefits: You have the optional benefits which can be added by paying the extra premium with your existing premium. It's optional.

- Premiums: Premiums are paid by monthly, quarterly, half-quarterly or annually through salary deductions, or you can pay directly. The premiums will be decided based total amount [maturity amount] and the policyholder can decide the premium amount. For the age between 12 years -49 years the minimum premium amount is Rs 250 / month and for the age between 50 years -60 years, the minimum premium amount is Rs. 400.

- Loyalty additions: Here, you get the share of profit in the form of loyalty amount which will be paid with the maturity amount. You might need to pay the loyalty additional from the 10th year onwards.

Lic Jeevan Saral Statement Download Online

Guaranteed Surrender

- If the policyholder surrenders his/her policy, then the guarantee will calculate the 30% they paid the premium in total except the first year premium and additional payments. You can surrender the policy only after the 3 years of the policy.

- Once you complete the 3rd year of premium, but not 4 years premium, you get 80% of the sum assured amount.

- You get the 90% of sum assured amount once you complete the 4th year of premium, but not 5th year of premium.

- For 5years or more, you get 100% of the sum assured amount [if all premiums are paid].

Policy Exclusion

If the policyholder is committed suicide within 1st year of the policy, according to the policy term the backup plan isn't subject to pay any claim under LIC Jeevan Saral Policy.

Documents Required For Jeevan Saral Policy

- Address proof

- Identity proof

- KYC documents

- In some specific cases, you need to go for medical tests[depends on the sum assured amount and person's age]

Other Details

Maturity Benefit Chart of LIC Jeevan Saral Plan 165 shows the maturity amount for monthly premium from 250 times to 6000. There is no maturity benefit for 1st & 2nd term period. Partial surrender of policy is allowed after 3rd year. Pdf to microsoft word converter free download.

Related Charts:

Top Calculators

Popular Calculators

Top Categories

LIC Jeevan Saral plan launched in 2004, this policy is with a lot of flexibility. Jeevan Saral policy is one of the easiest policies for common people. This policy is pure protection for your family, in case of policyholder's death; this policy will easily replace the breadwinner's income. The maturity sum amount relies upon the age at the entry of the life to be assured and is survival on till the end of the policy term. It also offers the flexibility of terms and a lot of liquidity. In the case of policyholder's death, the money will go to family members of the policyholder.

Class 66 drivers manual pdf. LIC is one of the trusted brands in the insurance field, where they are providing many types of insurance products for everyone's requirements and budgets. Millions of Indian people put their money and trust in this company to make sure their loved one's future financially secure. It is setting up your secured future with a quality assurance plan under the set of the amount in the mode of premium payment.

Features Of LIC Jeevan Saral Plan

In Jeevan Saral policy, the premium amount will be decided by the policyholder as per his/her requirement, and the sum assured amount will be the 250 times of their monthly premium. At the end of the tenure, they will get the maturity amount [sum assured] with loyalty additions. The maturity sum assured depends on the different entry ages and policy terms that will be informed at the beginning of the policy.

- The policyholder can choose to select the premium amount and sum assured amount as per their requirement.

- You can partial surrender from the 4th year onwards [after the 3rd policy year] certain terms and conditions.

- You will get the demise benefit in addition to the return of premiums barring additional premium and first-year premiums with a loyalty addition.

- Maturity benefits

- The death benefit is directly related to the premiums paid.

- Loyalty additions only after the 10th-year policy.

Eligibility For LIC Jeevan Saral Policy

- The sum assured amount is at least 25 times of the monthly premiums.

- The minimum term is 10 years and the max term is 35 years for the policy.

- The minimum premium payment is 10 years and the maximum premium payment is 35 years.

- The minimal age for insured is 12 years and the maximum is 60 years.

- For maturity, there is no minimum age limit and for maximum age is 70 years age limit.

- You can pay a maximum monthly premium is Rs 10,000.

| Minimum Age | 12 Years |

| Maximum Age | 60 years |

| Policy Term | 10 Years – 35 Years |

| Maximum Monthly Premium | Rs. 10000 |

| Maximum Maturity Age | 70 Years |

| Sum Insured | 250* Monthly Premium |

Jeevan Saral Policy Benefits

- Death Benefits: In the case of policyholder's death within the policy tenure, the complete benefits will go to the nominee including the assured sum amount and return of premiums excluding rider premium and first-year premium amount and additional loyalty amount[if any].

- Maturity Benefits: Policy maturity amount is the sum assured amount with loyalty additional [if any] all amount will come in a lump sum.

- Income Tax Benefits: Under sec 80 C, The amount paid for Jeevan Saral policy premiums are income-tax-free. This policy is tax exempted under the section of 10D, the maturity proceeds of this policy.

- Extra Benefits: You have the optional benefits which can be added by paying the extra premium with your existing premium. It's optional.

- Premiums: Premiums are paid by monthly, quarterly, half-quarterly or annually through salary deductions, or you can pay directly. The premiums will be decided based total amount [maturity amount] and the policyholder can decide the premium amount. For the age between 12 years -49 years the minimum premium amount is Rs 250 / month and for the age between 50 years -60 years, the minimum premium amount is Rs. 400.

- Loyalty additions: Here, you get the share of profit in the form of loyalty amount which will be paid with the maturity amount. You might need to pay the loyalty additional from the 10th year onwards.

Lic Jeevan Saral Statement Download Online

Guaranteed Surrender

- If the policyholder surrenders his/her policy, then the guarantee will calculate the 30% they paid the premium in total except the first year premium and additional payments. You can surrender the policy only after the 3 years of the policy.

- Once you complete the 3rd year of premium, but not 4 years premium, you get 80% of the sum assured amount.

- You get the 90% of sum assured amount once you complete the 4th year of premium, but not 5th year of premium.

- For 5years or more, you get 100% of the sum assured amount [if all premiums are paid].

Policy Exclusion

If the policyholder is committed suicide within 1st year of the policy, according to the policy term the backup plan isn't subject to pay any claim under LIC Jeevan Saral Policy.

Documents Required For Jeevan Saral Policy

- Address proof

- Identity proof

- KYC documents

- In some specific cases, you need to go for medical tests[depends on the sum assured amount and person's age]

Other Details

On the off chance that you quit making premiums from the 3rd year of the policy, the paid-premium sum will reduce the sum assured amount by the policy. The policy will not qualify for any future additions regularly.

Jeevan Saral Bonus

Zen nomad jukebox drivers. The policyholder can take the loan against the Jeevan Saral policy.